How to Reduce Customer Churn in Three Simple Steps: Part 2

Now that we’ve shown how Machine Learning can help you immediately reduce customer churn, today we’re going to dive into how we can use Everywhere’s predictive modeling to forecast churn broken out by recurring support themes, events, and even actual customers.

How Do You Know When A Customer Will Churn?

With Everywhere, it’s actually quite easy to predict when a customer will churn, using the data you already have! Once your support tickets, surveys, sales data, and / or user session data are connected to our platform, a custom ML model is trained on the user events of customers who ultimately churned. In a matter of hours, the platform learns what churn looks like, based on how customers use your product, engage with your brand, how they ask for help, and what areas they seek help in.

This model then predicts the correlation between a specific person, account, or theme and short, medium, and long term churn risks. In the case of customer accounts, this relates directly to when a specific account is likely to churn.

How Do You Strategically Forecast Churn?

Everywhere’s churn models can forecast customer churn several months into the future, either at a high level or with granular detail.

Below we can see the breakdown for each Risk Forecast group seen above: Immediate Risk, At Risk Soon, and Long Term Risk, each shown with its corresponding number of days that churn is predicted to land within. Additionally, at a glance we can see a forecast of the revenue and subscribers predicted to be lost within each category, alongside their respective churn rates.

This same model can be applied to any theme, tag, region, employee, or almost any natural language in your existing data. For example, the Everywhere platform uses AI to automatically group your customer conversations into themes, and we can see at a glance, each of those themes is coded as an immediate, near, or long term risk.

From there a detailed churn forecast is just one click away. When we explore a particular theme, say, “The customer is not happy with the product they received”, we see the following about customers who expressed their unhappiness with the product they received:

Roughly 12 of these customers will churn in the next 33 days

17 customers are expected to churn within the next 49 days

28 customers are expected to churn within the next 60 days.

Additionally, we can see that in this case, nearly $29,000 in revenue is associated with these 28 customers and that, historically speaking, high percentages of customers who expressed this sentiment did, in fact, end up canceling their subscriptions.

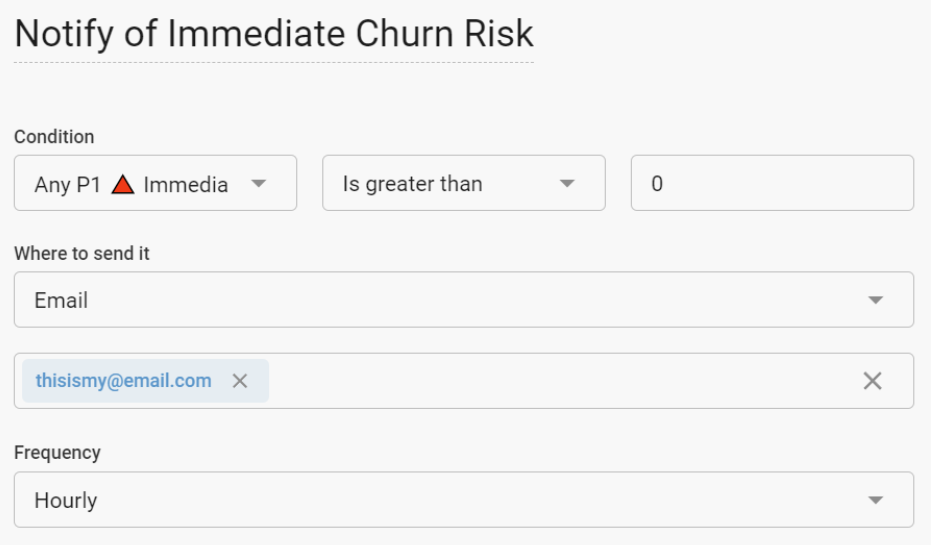

Now that we have explored some basic themes that are highly correlated with churn, Everywhere users can configure the platform to monitor Short, Medium, and / or Long Term risk conversations as soon as they are surfaced.

Above we can see an example of the big-picture churn forecast for the company, and as users zero in on the most painful themes that customers experience, Everywhere can monitor them and trigger an alert for any customer that meets the same criteria.

Reducing customer churn can be difficult…or quite easy with the right technology in place. To learn more about how Everywhere can help you reduce customer churn right now, drop us a line and we’ll get you started!